Podcast: Play in new window | Download

Follow TBCY RSS

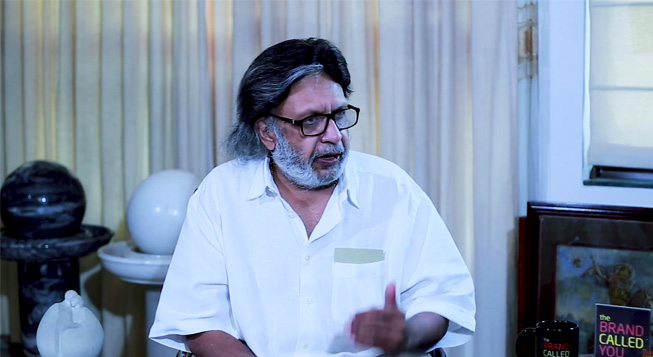

Anil Khaitan, Chairman SNK Corp., attended Vincent High School, Mussoorie and thereafter completed his B.Com Degree and joined his family business of jute. He pursued his MBA from IMI, Geneva. Anil has diversified business experience relating to the Jute Industry, Paper Industry, Pharmaceutical Industry, Copper & Steel Industry, apart from managing his company’s International Operations.

With decades of experience in business, he is and has been associated with several notable bodies. He was the Immediate Former President, PHD CCI, Member – Managing Committee, ASSOCHAM, Chairman- National Council on Start-Ups, ASSOCHAM, Member-CII Regional Committee on Healthcare amongst a host of other associations.

We spoke to him about his various businesses and how he handles them, his journey from jute to digital marketing, and were privy to his magnificent personality.

On his journey

Anil was the oldest son out of 5 sons and was put through the grind by his father. His father encouraged him to travel by local transport where he saw a life very different from the one he was used to living. His training went on for three years, during which he worked on the shop floor. He later managed Shalimar Industries and faced many challenges with its operations, owing to the large turnaround period on credit and cash flow.

Keen on studying business, Anil then went to IMI in Geneva for an MBA. On his return, he was made the vice-chairman of the entire group. The businesses have now been divided between the five brothers who manage them efficiently and coordinate quarterly.

Today, Anil spends most of his time on building relationships and networking.

“To be successful, you need the skill and the will.”

“The skill is what takes one forward. But once one grows in an organization, there must also be the will to convert contacts into relationships.”

He stresses on the importance of understanding behaviour and acting accordingly. He thinks that networking opens doors that would take a year within one week.

“99% of the people today are hired or fired because of behaviour.”

On ‘vegetarian’ capsules

Anil entered the pharmaceutical industry with capsules. The industry for capsules is a small one with the worldwide size being only $5 billion. However, it has very high margins which make them very lucrative.

“The profit before tax is generally 20-22%.”

On the demand for vegetarian capsules, he explains the process. Capsules have traditionally been made from gelatin that was extracted from the bones of cattle. With increasing awareness, more and more people are demanding vegetarian capsules.

These vegetarian capsules are made from the residue of the pulp of pine trees used to make paper. The cost of these are almost 3 times as much as that of gelatin capsules. They also disintegrate much slower than gelatin capsules and so have more utility in nutritional sectors rather than pharmaceutical.

On industry association

Having been associated with venerable bodies in the industry, Anil is a stalwart in his space. His regular exposure and interactions with decision makers provides him a platform to suggest changes as well. Anil says that these bodies have become far more effective because the Government has realized that unless they consult with these associations, their policy decisions may be untenable and unreliable.

He also points out that associations in the country have now tied up with many international associations. This is facilitating a lot of transfer of knowledge. Anil says that he has found a regularly asked question amongst ministers and decision makers of late – ‘what is the best international practice?’

He cites an example – “After the US slashed taxes from 35% to 21%, I suggested to the then Finance Minister, Mr. Arun Jaitley, that we should do the same. I had a hunch that the overall tax collection would increase by this method. This was only implemented very recently, but it was the need of the day.”

Commenting on the present tax slash to 15% for new investments to be commissioned before March 2023, he says that it is a fantastic step. He thinks that foreign investment is crucial for India given the size of its budget. With the current size of the budget, most of the funds are already committed to fixed purposes with very little leftover to invest in infrastructure building. Moreover, India is in the dangerous position of a fiscal deficit that is equal to the interest it pays. These problems can only be solved by increasing the size of the budget, in which foreign investments can help tremendously.